The term Payee refers to a non-resident individual or organization other than a Malaysian. Withholding tax means an amount.

The gross amount which billed from Company N is equivalent to RM10000.

. Company N is a foreign company providing services to a Malaysian company called Company M. The Withholding Tax is to be paid to the Malaysian Inland Revenue Board Inland Revenue Board IRB. Malaysia is subject to withholding tax under section 109B of the ITA.

The dam will take 1 year to be built. Ltd a foreign company earns interest income from its subsidiary. Revenue stream in scope.

Here I will share 4 things Yamae needs to know about withholding tax on interest income if Mochiko Co. If withholding tax 10 is to be applied on above transaction then. See Withholding Tax Deduction.

WTH tax 10 on gross amount 10 on 1200 120. Assuming that the foreign service provider is based in Singapore if the service is considered under Special Classes of Income eg. Company purchases raw material from vendor of 1000 with 20 input tax.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. Payments for technical advice assistance or services is subjected to withholding tax including any portion of work done outside Malaysia. A If the Lead Securitization Note Holder or the Mortgage Loan Borrower shall be required by law to deduct and withhold Taxes from interest fees or other amounts payable to any Non -Lead Securitization Note Holder with respect to the Mortgage Loan as a result of such Non-Lead Securitization Note Holder.

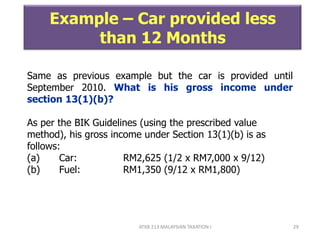

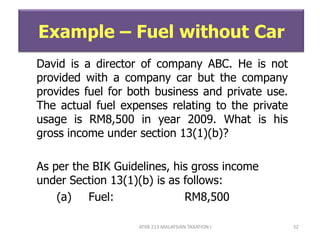

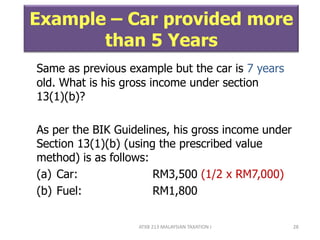

--Please Select-- 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009. The Malaysian Income Tax Act 1967 ITA 1967 provides that where a resident is liable to make payment as listed below other than income of non-resident public. Technical Fees it will.

--Please Select-- FORM CP37 FORM CP37A FORM CP37C FORM CP37D FORM CP37D1 FORM CP37E FORM CP37E Resident Non-resident FORM CP37F FORM CP37G FORM CP147 FORM CP1471 FORM CP107D Semua All Year. Withholding tax is an amount withheld by the resident carrying on business in Malaysia on income earned by a non-resident and paid to the Inland Revenue Board of Malaysia. Gross amount 1000 net amount 200 tax 1200.

Lets assume the withholding tax rate is 10. Net amount 1000 and tax amount 200. Based on the Income Tax Act 1967 a non-resident of Malaysia will be liable to payment of withholding tax on interest income if he derives interest rates from loans in Malaysia.

For example A engages B who is a foreign consultant to give consultation on a project and. The withholding tax in Malaysia is an amount withheld by the party making payment payer on income earned by a non-resident payee. Royalty paid to NR.

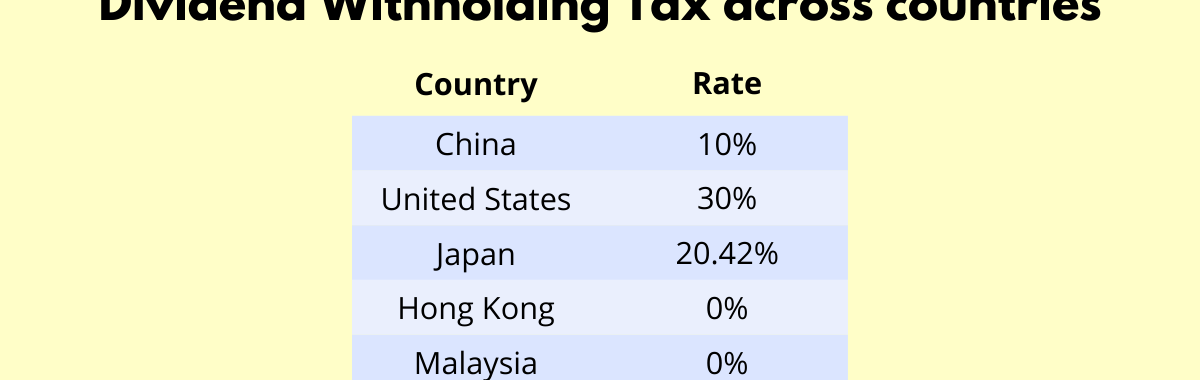

Example of Withholding Tax. For example the DTA between Malaysia and Singapore reduces withholding tax rate in respect of royalties and technical fees to 8 and 5 respectively. Any non-resident company receiving income from the use of or right to use software or the provision of services.

Affected business modelsin-scope activities. Withholding tax is a percentage of income received by a non-resident that is withheld by the person making the payment the payer payee. An individual body company carrying on business in Malaysia.

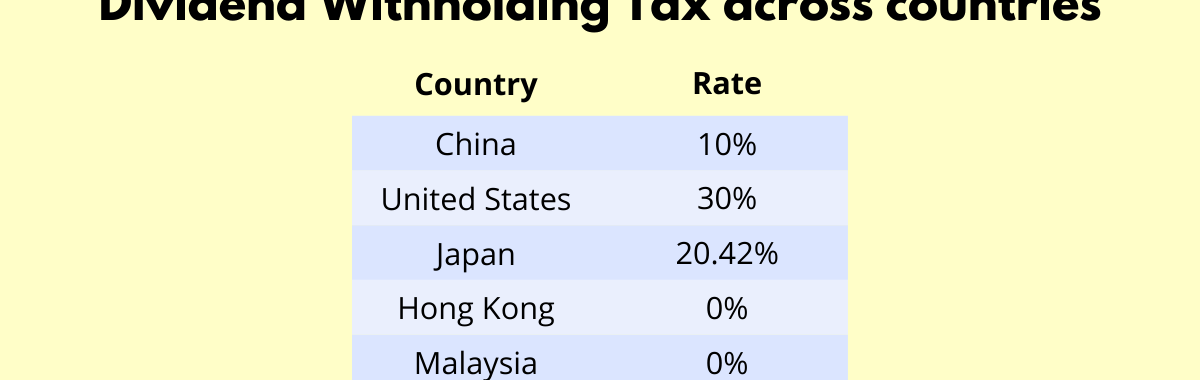

Interest Paid to Non-Resident Persons Payee Interest paid to a NR payee is subject to withholding tax at 15 or any other rate as prescribed under the Double Taxation Agreement between Malaysia and the country where the NR payee is tax resident. The tax withheld must be paid to the Internal Revenue Department IRD within fifteen days from the date of withholding. Though he earns 6000 a month his employer withholds 1500 from his paycheck leaving 4500 for John.

To withholding tax has been redefined effective 17th January 2017 resulting in significant broadening of the scope of payments to which the withholding tax applies. Individuals except 1099 employees can easily look. Withholding tax means an amount representing the tax portion of an income of a non-resident recipient withheld by the payer in Malaysia.

Malaysia has entered into more than 60 bilateral DTAs. These DTAs commonly provide for either an exemption or reduction in the prescribed rate for certain types of withholding taxes. Download Form - Withholding Tax Category.

Example 1 Syarikat Maju Sdn Bhd a Malaysian company signed an agreement with Excel Ltd a non-resident company to provide a report addressing the industry structure market conditions and technology value for the Multimedia Super Corridor Grant Scheme. Of that 1500 parts of it goes to state income tax federal income tax unemployment and Medicare liabilities. This is a final tax.

Headquarters of Inland Revenue Board Of Malaysia. As we know WTH tax percentage is applied on gross amount. This amount has to be paid to LHDN.

Damit Pty Ltd an Australian company is engaged by MM Sdn Bhd to build a dam in Ulu Langat Selangor. Withholding tax is applicable on payments for certain types of income derived by non-residents. Withholding tax rates are 10 3 The 10 is in respect of the tax liabilities of the non-resident contractor while the 3 is for the tax liabilities of the employees of the non-resident contractor.

Lets say Johns yearly salary is 72000.

Form W 8ben Definition Purpose And Instructions Tipalti

Form 1116 Step By Step Guide To Claim The Foreign Tax Credit

Gross Income Formula Step By Step Calculations

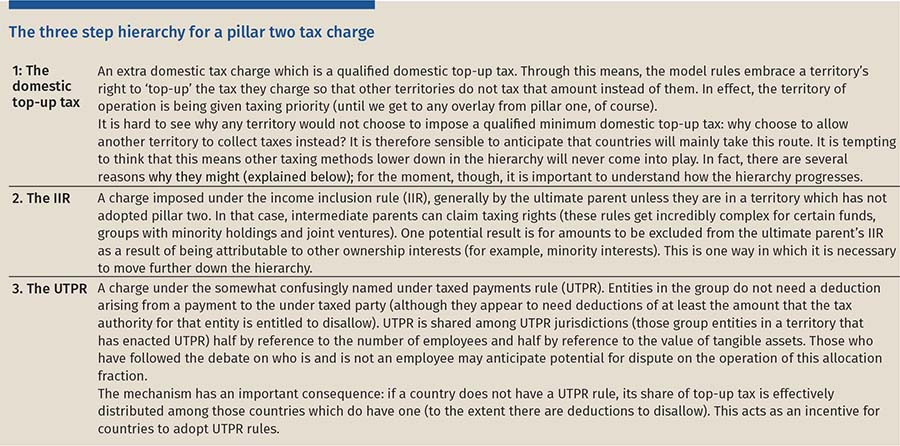

How Pillar Two Attacks Multinationals High Tax Subsidiaries

U S Dividend Withholding Tax What Singapore Investors Must Know

Payroll Tax What It Is How To Calculate It Bench Accounting

Tax Write Offs For Athletes Awm Capital Awm Capital

Gross Income Formula Step By Step Calculations

How Pillar Two Attacks Multinationals High Tax Subsidiaries

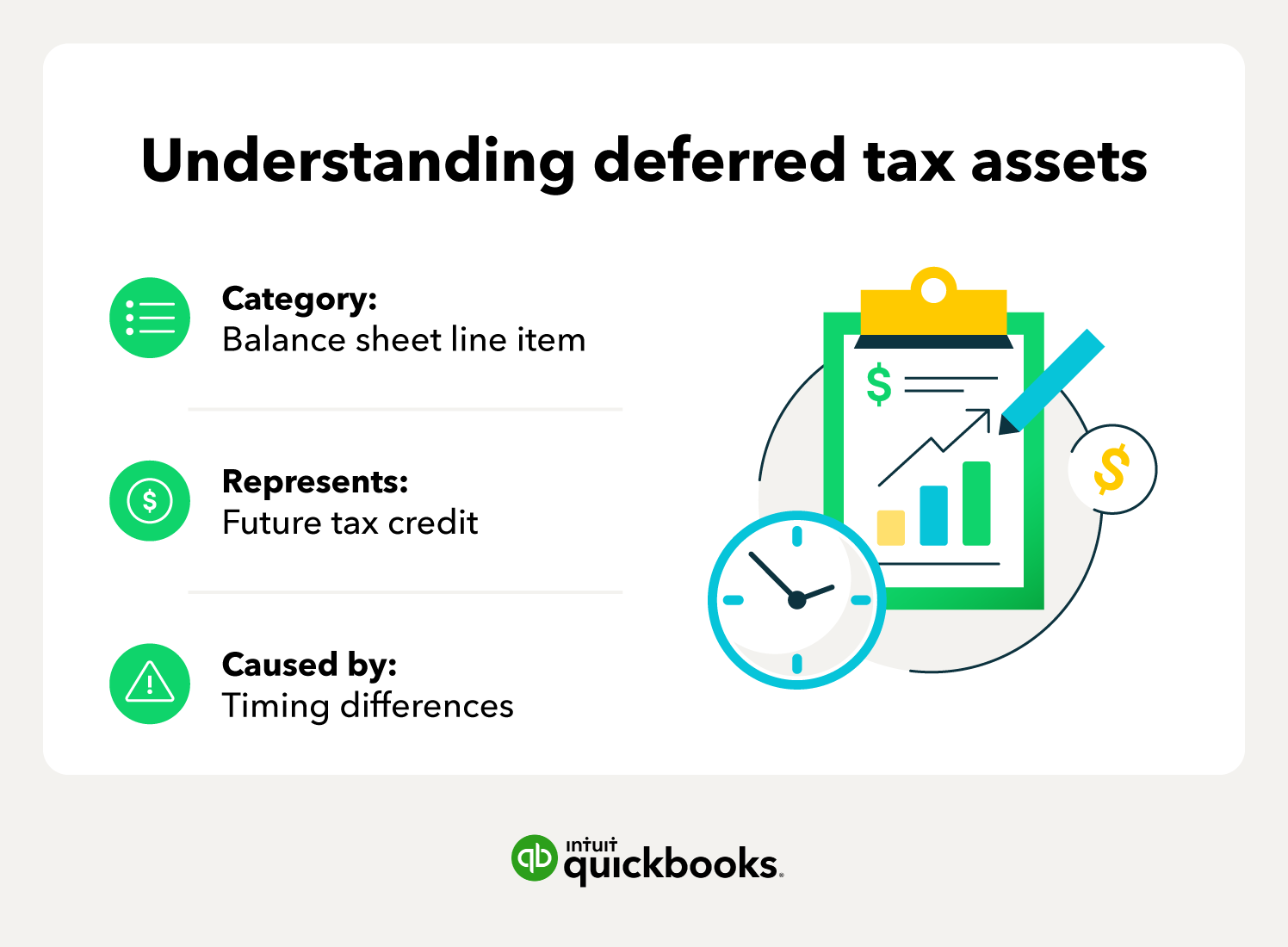

What Are Deferred Tax Assets And Deferred Tax Liabilities Article

Form 1116 Step By Step Guide To Claim The Foreign Tax Credit

Form 1116 Step By Step Guide To Claim The Foreign Tax Credit

Solved 1 Differentiate Between Direct Taxation And Chegg Com

Form 1116 Step By Step Guide To Claim The Foreign Tax Credit

Form 1116 Step By Step Guide To Claim The Foreign Tax Credit

Gross Income Formula Step By Step Calculations